The Right Money

Imagine you have set up enough solar panels to power your entire house, your farm, your EV, and everything else. You are not connected to the grid at all.

If there is an outage in your city, you are not affected. If there is an electricity price hike, you are not affected. If a country stops supplying coal to your country, which is essential for power generation, you are not affected.

Now, compare this to the money we regularly use. In the year 2000, you could buy a liter of milk, 10 eggs, a loaf of bread, and some chocolates for ₹100. But today, it buys you only a liter of milk and 7 eggs.

Remember, it is the same quality of milk and eggs. Nothing has changed, but your money has weakened.

Inflation = your money got weaker

This is because there is a limited supply of milk and eggs at a certain time compared to the money, which can be printed whenever the government wants.

If this money were not printed for, say, two years, you would see the prices of everything dropping. People would start hoarding money because it is scarce now. A seller would do anything to get money from you, and they would decrease the prices of their goods first.

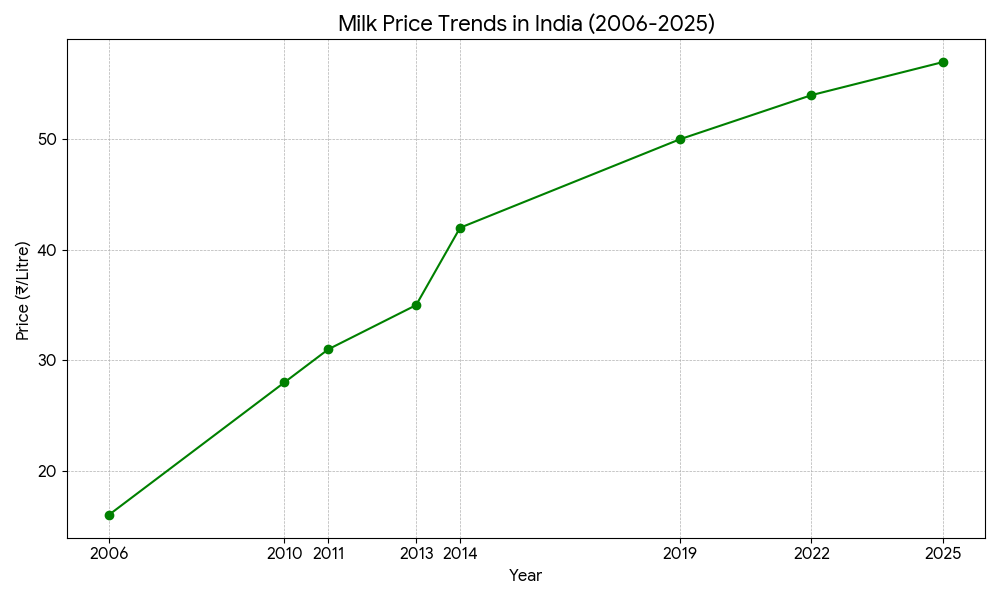

Here is an example of how rupee looses its value against milk.

I’m giving the example of milk because we buy it every day. Milk is the same, but the price changes, and almost always the price increases.

If you have a cow or buffalo at home, you wouldn’t mind what the prices are.

This is not just the case with Indian Rupees; it is true for all fiat currencies in the world. One may be stronger than the other, but

All fiat currencies are deflationary.

Everything Should be Cheap

As per Jeff Booth, the natural state of the free market is deflationary. He has written a book called The price of tomorrow which mentions the same thing.

He is now a backer of the true money which you will get to know in sometime.

Technology should make everything cheaper over time.

Today, we have huge milk processing units that automate the collection, filtering, pasteurization, fat separation etc using machines. This should have gotten the milk prices low. But that isn’t the case isn’t it?

But when you compare the commodity prices as per fiat currency then yes the prices are going up.

But what if there was a type of money that kept its value constant? Everything else would lose value against it. It has some special features that make it a constant:

- it doesn’t get printed

- it is limited in supply

- it is not controlled by any authority

- it can be used to buy and sell things

- you can divide in into minute fractions

- it isn’t physically present & cannot be destroyed

- it is connected to the physical world by proof-of-work

- it is so transparent that you can see all the transactions by everyone!

₿itcoin - The Right Money

You probably already guessed it, and you are right. It is Bitcoin—not any other cryptocurrency, but just Bitcoin. People hoard it a lot because its value keeps growing against any other asset class.

I’m not an investment adviser, but along with your real estate, equities, gold, FDs, etc., have a little bit of Bitcoin.

Here is a chart of S&P 500 vs Bitcoin

The gap is so vast that it is unbelievable. In the future, you can buy a house in India for mere 0.05 Bitcoin.

I would even ask you to go all-in, but there could be events in the future where governments might try to stop us from using Bitcoin.

In such a situation, you should have other assets for your rescue.

It has become a real pain to buy bitcoins in India. But if you are in a country where you can buy bitcoins without much hassle, then please own at least a fraction of one.

If you own any, keep it in self-custody. Never leave it in an exchange. They get hacked all the time.

Understanding Bitcoin might feel a little intimidating at first but if you spend some time to see why it was based on proof-of-work then you can differentiate between Bitcoin and other altcoins.

If you are interested in buying crypto, only buy Bitcoin for now, even if you get only a 1000th of a fraction of Bitcoin. That fraction can be generational wealth in the future.

Start Here

- Bitcoin Whitepaper

- Bitcoin Standard by Saifedean Ammous

- The Price of Tomorrow by Jeff Booth

- The Exit Manual

- Rajat Soni, CFA

Disclaimer

This is not an investment advice.

Subscribe to future articles

No spam, once a month email.